Streamate Representative’s Email to Select Models Addresses AB5

A representative at Streamate issued the following email yesterday to select models, on December 5, 2019. Its content concerns California’s AB5.

A representative at Streamate issued the following email yesterday to select models, on December 5, 2019. Its content concerns California’s AB5.

Per YNOT, AB5 changes the criteria for who can be considered an independent contractor versus an employee. The law also seeks to grant the newly dubbed “employees” benefits and protections like overtime pay, minimum wage and workers’ compensation.

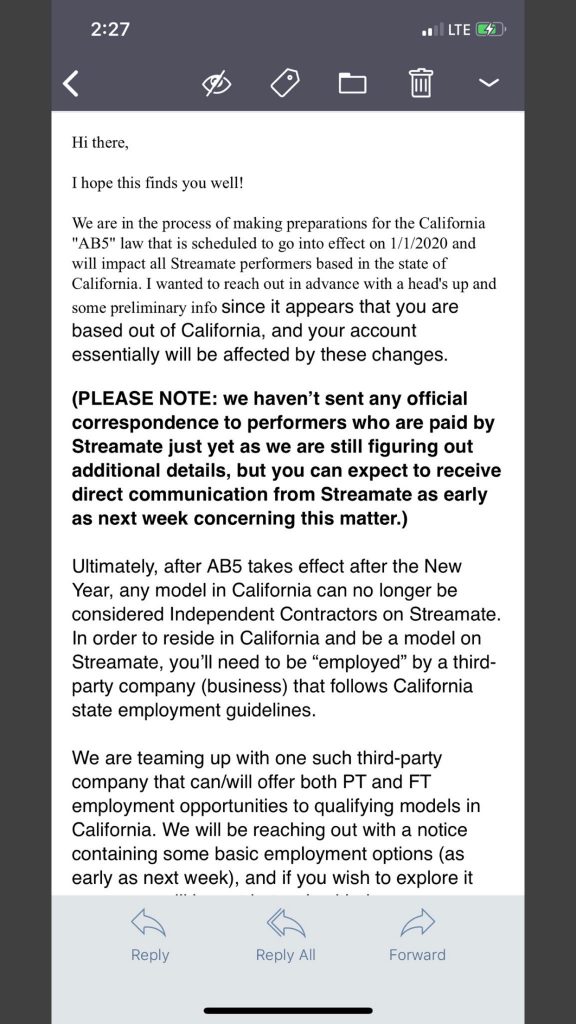

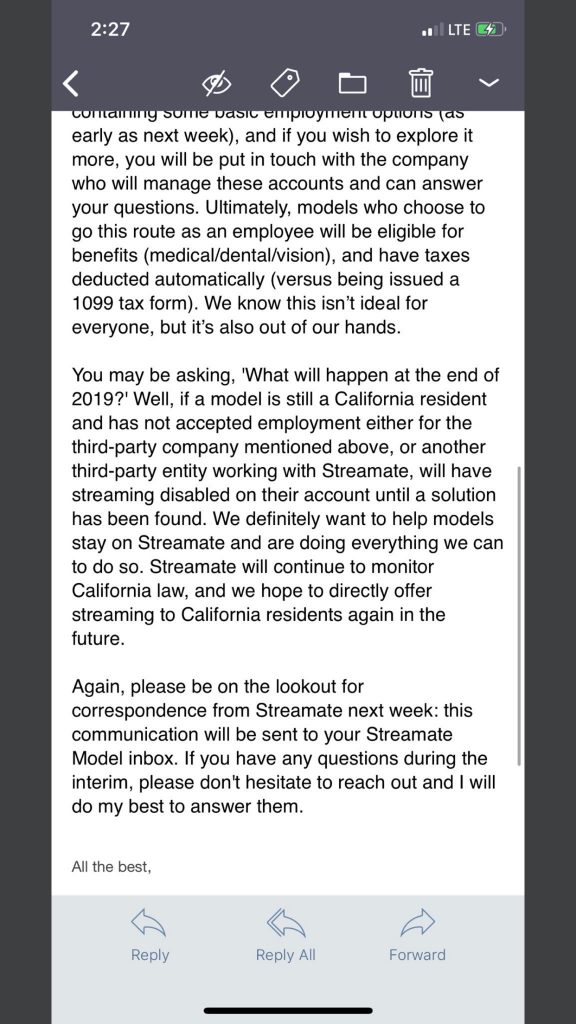

The message has been reproduced below, and screengrabs of the original email follow.

Hi there,

I hope this find you well!

We are in the process of making preparations for the California “AB5” law that is scheduled to go into effect on 1/1/2020 and will impact all Streamate performers based in the state of California. I wanted to reach out in advance with a head’s up and some preliminary info since it appears that you are based out of California, and your account essentially will be affected by these changes.

(PLEASE NOTE: we haven’t sent any official correspondence to performers who are paid by Streamate just yet as we are still figuring out additional details, but you can expect to receive direct communication from Streamate as early as next week concerning this matter.)

Ultimately, after AB5 takes effect in the New Year, any model in California can no longer be considered Independent Contractors on Streamate. In order to reside in California and be a model on Streamate, you’ll need to be “employed” by a third-party company (business) that follows California state employment guidelines.

We are teaming up with one such third-party company that can/will offer both PT and FT employment opportunities to qualifying models in California. We will be reaching out with a notice containing some basic employment options (as early as next week), and if you wish to explore it more, you will be put in touch with the company who will manage these accounts and can answer your questions. Ultimately, models who choose to go this route as an employee will be eligible for benefits (medical/dental/vision), and have taxes deducted automatically (versus being issued a 1099 tax form). We know this isn’t ideal for everyone, but it’s also out of out hands.

You may be asking, ‘What will happen at the end of 2019?’ Well, if a model is still a California resident and has not accepted employment either for the third-party company mentioned above, or another third-party entity working with Streamate, will have streaming disabled on their account until a solution has been found. We definitely want to help models stay on Streamate and are doing everything we can to do so. Streamate will continue to monitor California law, and we hope to directly offer streaming to California residents again in the future.

Again, please be on the lookout for correspondence from Streamate next week: this communication will be sent to your Streamate Model inbox. If you have any questions during the interim, please don’t hesitate to reach out and I will do my best to answer them.

All the best,

Requests for comments from Streamate were not returned by publication time.

EDITOR’S NOTE: A previous version of this story referred to the email as a “statement” but we have updated the story to more accurately describe the nature of the communication.